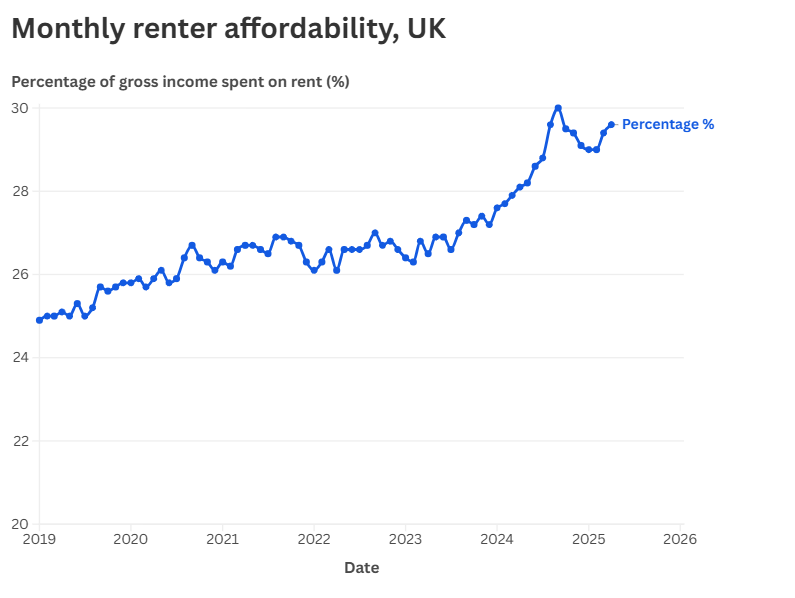

The percentage of gross income spent on rent has increased to a height of 29.6% in April according to Dataloft Rental Market Analytics.

The income spent on rent reached a peak in September of 2024 of 30% but since then has declined ever so slightly and has not receded beneath 29% since.

In comparison in January 2019 the gross income spent on rent was on average 24.9% and for the whole of 2019 the income did not reach or exceed 26% meaning between January 2019 to April of this year there has been an increase of 4.7% in average income spent on rent.

Sarah, 32, who rents an apartment said: “I rent a 1 bed garden flat in North London for £1150 a month.

“Bills on top are approx. 350-400 for council tax, utilities, internet and things like union payment, deezer etc.

“That’s excluding groceries and transport though.

“I’m fortunate in that my landlady hasn’t raised my rent in a couple of years but I expect she will this year.

“Saving has been an impossibility until very recently, but only because the rent has been stable and my pay has increased.”

DRMA aggregates data from tenant referencing companies and adds around 30,000 new tenancies and 50,000 new tenants per month covering about 30%-40% of all rentals in the United Kingdom.

Rent prices in London are the highest anywhere in the UK with the average monthly rent across London in April 2025 being a eyewatering £2,081.

In response to the high rent prices the mayor of London Sadiq Khan said: “These figures reveal the clearest picture yet of why rent controls are so necessary.

“Private renters make up nearly a third of everyone living in the capital, but they are being consistently let down by a government that refuses to listen and take urgent action to protect them from even greater financial hardship.

“Londoners re-elected me on a manifesto pledge to push for the powers to control rents and I will not stop advocating for this lifeline on their behalf.

“I am delivering on my promise to build a better, fairer and more prosperous London by building more affordable homes in the capital and providing vital support to Londoners through the cost-of-living crisis.

“It’s about time the Government did the same.”

Energy prices are also generally on the rise, particularly in the UK.

While they’ve fallen since the painful peak of the energy crisis in 2022, they are still significantly higher than pre-crisis levels and have started to increase again.

The UK energy price cap has been steadily increasing since October 2024 and is expected to remain high throughout 2025.

Water bills are also increasing this year with an average water bill projected to increase to 26%.

In London sharing properties has become a common way to curb the expense of one’s salary by splitting bills and rent.

The Office for National Statistics estimates that around 515,000 people in London are in shared accommodation, a growing trend as the cost-of-living increases.

Furthermore, the 2021-22 English Housing Survey indicated that more than a quarter (29%) of homes in London are privately rented, a higher proportion than the UK average, suggesting a large number of people are sharing rent in this sector.

Pea, not his real name said regarding the cost of living: “£2600 for a two bed flat in zone two London split with my partner.

“Council tax is about £170 month split, and other bills are less than £200 which again we split.

“Totally for me is around £1400.

“We moved recently and didn’t struggle too much to find somewhere but anyone on a lower budget would have done because there just weren’t any properties available, previously I’ve rented rooms in two bed flats in zone two for less than £800/month.

“Absolutely nothing on the market in that ballpark anymore.

“Everything was £1000+ per room.

“I don’t think our flat is massively overpriced it’s just the cheaper options don’t seem to exist anymore.”

The price of rent is expected to continue to rise but is expected to slow down sometime in 2025 according to Savills.

Join the discussion